As we close the books on the month of October in the stock market, the general market indices have continued to decline, making this week one of the worst since the month of March. There was nowhere to hide as the bears continued to take over and control the markets. All three major indicies broke through key price levels, the Dow Jones Industrial Average, the Nasdaq as well as the Standard and Poors 500. The price of gold, silver and oil moved lower.

As for now the market is a confirmed down trend and the best thing any investor can do at this point is go to cash or simply sit on the sidelines, as stocks get cheaper. I would rather be a spectator than try to catch a falling knife. Based on looking at the market downturn from a technical standpoint we will continue to see declines in the market in the week ahead.

The Dow Jones Industrial Average began the week trading at 28.185.85 but ended the week trading much lower. As for top advancing stocks in the Dow 30 this week all that was seen was bloodshed as every stock in the index ended the week trading lower. The worst declines came from companies such as (INTC) Intel down –8.13%, (V) Visa in which reported earnings earlier in the week down -8.23%, (AXP) American Express down -9.65%, Walgreens Boots Alliance down -10.52% and (BA) Boeing down -13.72%.

The index ended the week trading at 26,501.60 down -1,833.97 points or -6.47% on heavier than average weekly downside volume of 2.23 billion. To many it may seem as if this indices has moved higher for the year but its actually down -7.14 percent. Over at the Nasdaq the index ended the week trading at 10,911.59 down -636.63 points or -5.51% on heavier than average trading volume of 17.06 percent. The index is currently 10.65 % away from its August all time price high and 3.65% from its September price lows.

Out of all 100 stocks in the tech weighed Nasdaq 100, only five out of all 100 advanced. Automatic Data Processing ended the week up 5.87%, Charter Communications up +1.78% Xilinx up 1.60%, NTES up 1.07% and JD.com up 0.22%. At the Standard and Poors 500 it didn’t get any better as 26 out of all 500 stocks in the index moved higher to end the week.

The top five advancers in the index were BRE Group ended the week up +8.02%, Tiffany and Co. up 5.91%, Resmed, Inc. +4.87%, Perkinelmer up 4.10% and Newmont Corp up 3.92%. The S&P 500 ended the week trading at 3,269.96 down -93.04 points or -2.77% on heavier than average downside volume of 51.2 billion. The average weekly volume for the S&P 500 is 49.62 billion.

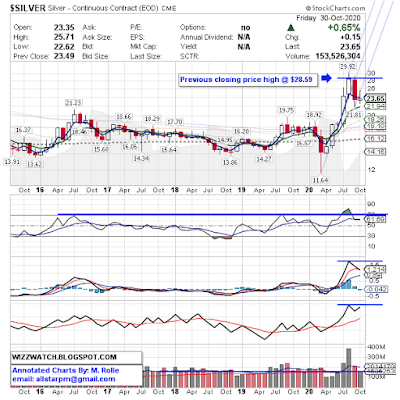

On the commodities front the price of gold has continued to decline for 7 of the past 12 weeks. The index closed to end the week treading at $1,879.90 down $25.30 or -1.33%. Silver saw a continued decline in price as well, as it moved lower for 5 of the past 12 weeks. The index ended the week trading at $23.65 down $1.03 or 4.07% on heavier than average downside volume of 41.7 million.

The oil index has had a brutal year after plunging to a price low of $6.50 per barrel back in April. The index has recovered since then, but it’s now retreating from its prior price high of $43.78 per barrel that it made in August. Oil prices hit a 5 month low as the index has been on a continued decline for the past 9 weeks as it broke through June price support at $39.55 per barrel earlier in the week.

There are many factors involved in reference to the decline of oil in the past few weeks, such as continuous Covid 19 lockdowns worldwide in which has caused weak demand in the industry. Also many oil companies have filed for bankruptcy protection, or simply have gone out of business. Airlines have also played a major part in the decline of oil prices being that they have cut back on budgets, furloughs, grounded fleets, as well as the cutting cut routes all together, being that they are not able to fly like they used to before the pandemic came along and changed the way they do business in what many consider as the new norm. .

Its just a bad situation that is not getting any better and the proof is in the pudding especially when you look at an oil giant like Exxon Mobile. This company was once considered to be King before Apple came along and took its crown away. As for the week that passed the company delivered its third consecutive quarter of negative earnings in comparison to positive earnings reports in every quarter for the past 3 decades.

The entire Industry has been taking a hit and based on technical analysis the downturn will continue in the days and weeks ahead. At the close of the market on Friday the oil index closed to end the week trading at $35.79 per barrel down $4.06 or -10.19% on lighter than average downside volume of 210.5 million. The average weekly trading volume for Exxon Mobile is 239.35 million.

The only thing we all can do going forward is go to cash and wait on opportunity to knock as the prices of stocks become discounts. Like the late great Zig Zigler once said, success occurs when opportunity meets preparation.

By Marlin Rolle

Please have a look at the general market charts below

No comments:

Post a Comment