The top industry indices were Airlines followed by the Dow Jones Forestry/Paper Index, Biotechnology, Health Products and Utilities. As for now the bears are continuing to beat the bulls as the market declines in order to correct itself going forward.

The April job numbers were released during the week that passed, the jobless rate increased by 9% from a 2 year low in March at 8.8%. Nonfarm payrolls climbed to 244,000 but the labor force remains week.

Private sector hiring also beat estimates as it had its best month in 5 years bolstering sentiment that the economy may continue to grow at a steady pace despite higher gas prices.

The U.S. Dollar index finally moved higher after weeks of continuous declines against a basket of currency pairs. In order for the dollar to move higher to the upside in the week ahead it must break above the 77.80 area. Upside resistance for the index is in the 81.50 area with downside support at $70.69.

There was a pullback in the price of gold, silver and energy stocks. The gold index began the week trading $1,563.90 per troy ounce but ended the week trading at $1,295.10 down -$68.10 or -4.36%.

The silver index has been making higher highs and higher lows for 12 of the past 16 weeks. The index ended the week trading at $35.60 per troy ounce down -12.27 or -25.63%.

As for the price of a barrel of crude, the oil Index also continued to move lower in price after weeks of upside momentum. The oil index ended the week trading at 97.33 down -16.61 or 14.58%.

The top market movers this week were (EONC) Eon Communications Corp. +116.15%, (OXGN) Oxigene, Inc. +102.23%, (ZSL) Pro Shares Ultra Short Silver +69.43%, (KNDL) Kendle Int’l, Inc. +49.55%, and (ADGF) Adams Golf, Inc. +49.18%.

The Dow Jones Industrial Average began the week trading at 12,810.16 but pulled back to the 12,521.28 area before ending the week slightly higher. The index has been making higher highs and higher lows for 5 of the past 7 weeks.

The Dow Jones Industrials is currently above its 5, 10, 32, 50 and 200 week moving averages. Downside support for the index is in the 11,778,38 area with upside resistance at 12,876.05.

The top movers in the Dow 30 were (AXP) American Express Co. +2.28%, (KFT) Kraft Foods, Inc. +1.46%, (MRK) Merck & Co. +1.22%, (HPQ) Hewlett Packard Co. +1.09% and (AA) Alcoa, Inc. +0.88%.

The Dow Jones Industrial Average ended the week trading at 12,638.74 down -171.80 points or -1.34% on heavier than average downside trading volume of 3.74 billion. The average weekly volume for the index is 3.62 billion.

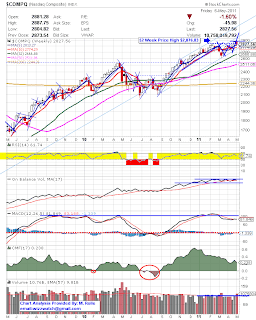

At the Nasdaq Composite Index there was a pullback in the index after moving higher to the upside for the past 2 weeks. The Nasdaq began the week trading at 2,881.28 before making a pullback to the 2,813.27 area. After the decline in price the Nasdaq recovered some of the loss as it advanced to end the week slightly higher to the upside.

The top Nasdaq 100 movers were (DISH) Echo Star Communications Corp. +16.65%, (ERTS) Electronic Arts, Inc. +7.78%, (ROST) Ross Stores, Inc. +6.11%, (GILD) Gilead Sciences, Inc. +5.59%, and (LINTA) Liberty Media Holding Corp. +4.92%.

Downside support for the tech weighed index is at 2,666.83 with upside resistance in the 2,887.80 area. The Nasdaq is currently above all of its moving averages but may move lower in the week ahead.

The Nasdaq ended the week trading at 2,827.56 -45.98 points or -1.60% on heavier than average weekly volume of 10.75 billion. The average weekly volume for the Nasdaq Composite Index is 9.48 billion.

The Standard and Poors 500 also declined after it began the week trading higher to the upside. The index is currently above its 5, 10, 32, 50, and 200 week moving averages. Upside resistance for the S&P 500 is at 1,370.63 with downside support at 1,267.46.

The top movers in the S&P 500 were (NVLS) Novellus Systems, Inc. +10.88%, (M) Macy’s, Inc. +7.78%, (ERTS) Electronic Arts, Inc. 7.78%, (OI) Owens Illinois, Inc. +7.15%, and (ROST) Ross Stores, Inc. +6.11%.

The S&P ended the week trading at 1,340.20 down -23.41 or -1.72% on heavier than average downside trading volume of 16.19 billion. The average weekly trading volume for the index is 16.06 billion.

By: Marlin Rolle

*** Please have a close look at the charts listed below ****

In order to have an in depth view of each chart, please double click.

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-gbp-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-cad-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-jpy-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-aud-small.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/platinum/t24_pt_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/palladium/t24_pd_en_usoz_2.gif)

No comments:

Post a Comment