The U.S. Dollar ended the week higher against a basket of major currency pairs as the price of oil moved higher after moving lower for 3 of the past 5 weeks. Oil ended the week trading at $76.83 per barrel or 2.63% higher as the price of gold pulled back for the first time in 5 weeks. The price of gold closed to end the week trading at $1,246.20 per ounce prior to breaking into all time price highs earlier in the week at $1,262.30 per troy ounce. Gold ended the week trading at The Volatility Index continues to slide for two of the past 3 months ending the week at 21.99 or 3.1% on the upside.

The top movers in the market this week were (BDCO) Blue Dolphin Energy +175.23%, (RDNT) RadNet, Inc. +28.49%, (NEXM) Nex Med, Inc. +27.23%, (CHNG) China Natural Gas +22.80%, and (SVA) Sinovac Biotech +20.92%.

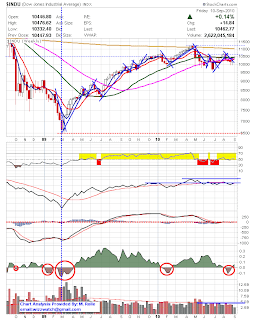

The Dow Jones Industrial Average opened to begin the week trading at 10,446.80 and moved to a price low in the 10,332.40 area before ending the week trading slightly higher to the upside. The index is now above its 5, 10, 32, and 50 week moving averages but below its 200 week moving average at 11,017.01.

The top price movers in the Dow 30 this week were (GE) General Electric +5.48%, J.P. Morgan Chase & Co. +4.17%, (CAT) Caterpillar, Inc. +3.97%, (DTV) Direct TV Group, Inc. +3.89%, and (MRK) Merck & Co. +3.71%.

The Dow Jones Industrials ended the week trading at 10,462.77 +14.84 or 0.14% higher on lighter than average trading volume of 2.62 billion. The average weekly trading volume for the Dow Jones Industrial Average is 3.94 billion.

At the Nasdaq there was also a continued move to the upside for the second week in a row. The Nasdaq began the week trading at 2,227.26 and ended the week trading much higher as it closed above its 5, 10, 32, 50 and 200 week moving averages. 50 200 week moving average for the first time in 4 weeks. The index is currently not

The top price movers in the Nasdaq 100 were (ORCL) Oracle Corporation +11.43%, (ADBE) Adobe Systems, Inc. +9.45%, (NTAP) Network Appliance, Inc. +7.57%, (NIHD) NII Holdings, Inc. +6.86%, and (APOL) Apollo Group, Inc. +6.47%. Downside support for the tech weighed index is at 2,099.29 with upside resistance in the 2,341.11 area.

The Nasdaq ended the week trading at 2,242.48 up 8.73 or 0.39% higher on the upside on lighter than average trading volume of 7.10 billion. the average weekly trading volume for the Nasdaq is 10.15 billion.

As for the Standard and Poors 500 the index also moved higher to the upside for 2 of the past 5 weeks. Upside resistance for the index is at 1,131.23 with downside support in the 1,039.70 area. As for now the index is currently above its 5, 10, 32, and 50 week moving averages but below its 200 week moving average in the 1,202.89 area.

The top movers in the S&P 500 this week were (JDSU) JDS Uniphase Corp. +16.04%, (ORCL) Oracle Corp. +11.43%, (CIEN) Ciena Corp. +10.78%, (ADBE) Adobe Systems, Inc. and (MCO) Moody's Corp +9.29%.

The S&P 500 ended the week trading at 1,109.55 +5.04 or 0.46% higher on the upside on lighter than average trading volume of 11.41 billion. The average weekly trading volume for the S&P is 18.31 billion.

By: Marlin Rolle

*** Please have a close look at the charts listed below ****

In order to have an in depth view of each chart please double click.

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-gbp-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-cad-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-jpy-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-aud-small.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/platinum/t24_pt_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/palladium/t24_pd_en_usoz_2.gif)

No comments:

Post a Comment