The top industry groups in the market for the week that passed were the Philadelphia gold & silver Index +4.10%, oil services +4.08%, the AMEX oil index +2.58%, the commodity related equity index +2.47% and the AMEX airline index +1.25%. The top stock movers in the market this week were (ATSG) Air Transport Services up +83.70%, (ARQL) Arquele +69.79%, (ENCO) Encorium Group +43.95%, (NGA) N. American Galvanizing +36.18%, and (BELM) Bell Microproducts +30.11%.

The price of gold ended the week trading at $1,126.80 per ounce up $19.70 or 1.78% higher for the week. The oil index also moved to the upside as it advanced to a new 52 week price high closing to end the week trading at $84.87 up $4.87 or 6.09% on the upside. It the oil index continues to advance we may see the price of oil at $100 or higher by July.

The job numbers released on Friday were considered positive for the economy. This is a signal that more unemployed persons are coming back into the workforce. The labor markets are improving at a slow pace so we may see the federal reserve keep interest rates low for the next few months. Payrolls were expected to increase by 184,000 but rose by 162,000 last month as private payrolls increased by 128,000 with 40,000 of the temporary jobs added by the U.S. Government. The unemployment rate holding steady at 9.7%

The Dow Jones Industrial average began the week trading at 10,849.23 but by the end of the week the index moved into a new 52 week high as it moved closer to the 11,000 point area. The Dow Jones Industrials are currently above its 5, 10, 32, and 50 week moving average but slightly below the 200 week moving average in the 11,132 area. If the market continues to advance and the index breaks above the 200 week moving average the Dow will continue to make higher highs and lows as it continues to advance.

Downside support for the Dow Jones Industrial Average is at 10,193.33 with upside resistance at 10,956.39. The top 5 movers in the Dow 30 this week were (DTV) Direct TV Group up +3.13%, (VZ) Verizon +2.73%, (CVX) Chevron Corp. +1.94%, (AA) Alcoa +1.80%, and (JNJ) Johnson & Johnson +1.45%. The Dow ended the week trading at 10,927.07 +76.71 or +0.71% on lighter than average volume of 2.63 billion. The average weekly trading volume for the index is 4.02 billion.

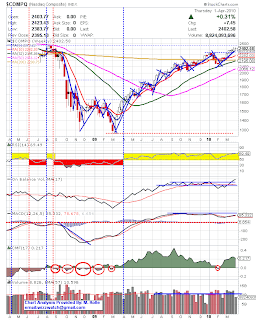

At the tech weighed Nasdaq Composite Index there was a continued move to the upside as the index advanced making higher highs and lows as it reach a new 52 week price high. The index has been on the run for the past 5 weeks. The Nasdaq began the week trading at 2,403.43 before moving to a price low at 2,383.77 but ended the week trading much higher. As for now the Nasdaq is above its 5, 10, 32, 50 and 200 week moving averages.

Upside resistance for the index is at 2,432.25 +7.45 or +0.31% with downside support at 2,195.08. The top movers in the Nasdaq 100 this week were (RYAAY) Ryanair Holdings PLC, +11.66%, (NTAP) Network Appliances +5.26%, (FWLT) Foster Wheeler Corp. +4.06%, (PPDI) Pharmaceutical Product Development +4.16%, and (LINTA) Liberty Media Holding Corporation +3.72%. The Nasdaq Composite Index ended the week trading at 2,402.58 +7.45 or +0.31% on lighter than average trading volume of 8.82 billion. The average weekly trading volume for the Nasdaq is 10.69 billion.

The Standard and Poors 500 moved higher this week for the fifth week in a row as it gets closer to breaking out above it 200 week moving average. The index is now at a 52 week price high as it continues its advance. The S&P 500 began the week trading at 1,167.71 but moved to a price low in the 1,165.77 area before ending the week higher to the upside.

Downside support for the index is at 1,093.56 with upside resistance at 1,181.43. The S&P 500 is currently above its 5, 10, 32 and 50 week moving averages but below its 200 week moving average at 1,225.30. The top movers in the index is at (PXD) Pioneer Natural Resources Co. +8.69%, (ESV) Ensco +8.61%, (RDC) Rowan Companies +8.32%, (SUN) Sunoco +6.99% and (DNR) Denbury Resources +6.71%. The S&P 500 ended the week trading at 1,178.10 +11.51 +0.99% on lighter than average volume of 14.01 billion. The average weekly volume for the Standard and Poors 500 is 18.49 billion.

By: Marlin Rolle

*** Please have a look at the stock charts below ***

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-gbp-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-cad-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-jpy-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-aud-small.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/platinum/t24_pt_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/palladium/t24_pd_en_usoz_2.gif)

No comments:

Post a Comment