The Dow Jones Industrial Average began the week trading at 10,005.43 but moved to a price low at 9,904.09 but ended the week trading higher on the upside after 4 of the past 5 weeks on the downside. The index needs to break above the 10,332.81 area in order to move higher in the near term. As for now downside support is at 9,846.92 with upside resistance at 10,729.89. The Dow Jones Industrials is currently below its 5, 10 and 50 week moving averages but above its 32 and 50 week moving averages for now. The top movers in the Dow 30 this week were (CAT) Caterpillar +10.67%, (AXP) American Express Co. +4.40%, (JPM) J.P. Morgan Chase & Co. +3.32%, (STX) Seagate Technology Holdings +2.86% and (KFT) Kraft Foods +2.57%. The Dow Jones Industrial Average ended the week trading at 10,0099.14 +86.91 or 0.87% on the upside on heavier than average trading volume of 4.41 billion. The average weekly trading volume for the Dow Jones Industrial Average is 4.33 billion.

At the tech weighed Nasdaq Composite Index there was also a price advance to the upside taking the index higher after weeks of price declines. The Nasdaq began the week trading at 2,140.10 but ended the week much higher. The index is currently above its 32, and 50 week moving averages but below its 5, 10 and 200 week moving averages. Downside support for the Nasdaq is at 2,109.01 with upside resistance in the 2,326.28. As for now the index is poised to move higher in the week ahead but will need to break above the 2,223.95. The top movers in the Nasdaq 100 were (MICC) Millicom International +11.43%, (BIDU) Baidu +10.10%, (NIHD) NII Holdings +10.10%, (ATVI) Activission Blizzard +9.35% and (CTSH) Cognizant Technology Solutions Corp. +8.02%. To end the trading week the Nasdaq ended the week trading at 2,183.53 +42.41 or 1.98% on heavier than average volume of 10.79 billion. The average weekly trading volume for the Nasdaq Composite Index is 10.40 billion.

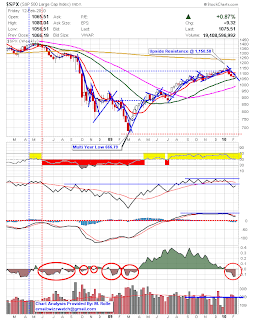

As for the Standard and Poors 500 there was an up-tick in the price of the index as it to moved higher after weeks of declines. The S&P 500 started the week trading in the 1,065.51 area before moving to a price low at 1,056.51. As the week came to an end the index ended the week trading higher but is currently below its 5, 10 and 200 week moving averages. In order for the index to move higher to the upside it must break above the 1,103.88 area. Downside support for the S&P 500 is currently at 1,056.69 with upside resistance at 1,150.45. The top movers in the S&P 500 this week were (HAR) Harman International,+24.51%, (AIG) American International Group +21.03%, (ODP) Office Depot +14.68%, (JDSU) JDS Uniphase Corp. +13.78%, and (CIEN) Ciena Corp. +12.70%. The S&P 500 ended the week trading at 1,075.51 +9.32 or 0.87% on the upside on heavier than average volume of 19.40 billion. The average trading volume for the S&P 500 is 19.30 billion as it moved into positive volume for the first time in the past 4 trading weeks.

By: Marlin Rolle

*** Please Have a look at the charts below ***

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-gbp-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-cad-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-jpy-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-aud-small.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/platinum/t24_pt_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/palladium/t24_pd_en_usoz_2.gif)

No comments:

Post a Comment